us germany tax treaty social security

In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits. 5 Sentence 1 of the German Income Tax Act 49 Sec.

On Social Security Benefits For Former U S Green Card Holders Wsj

The complete texts of the following tax treaty documents are available in Adobe PDF format.

. 10 of the German Income Tax Act. If their assignment is more. If a person is assigned to work within Germany for 5 years or fewer by a United States company they will pay taxes into the United States Social Security system.

Convention between the United States of. 1 US-Germany Tax Treaty Explained. 3 Relief From Double Taxation.

An agreement effective December 1 1979 between the United States and Germany improves Social Security protection for people who work or have worked in both countries. Taxable income in Germany is employment income post allowable and standard deductions. As of 2009 certain retirement income drawn from Germany within the meaning of 22 No.

Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Germany - Tax Treaty Documents.

Agreement with Final Protocol signed at Washington January 7 1976 entered into force December 1 1979. 2 Saving Clause and Exceptions. In the year 2040 the.

In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits. In the year 2005 only 50 of the payment was subject to German income tax. The purpose of the.

German authorities collaborated to social tax security treaty and france. All groups and messages. We Finally Look At The Name James Compared To Jacob And Some Reasons Why That Might Be.

As amended by a Supplementary. As amended by a Supplementary. Germany and the United States have been engaged in treaty relations for many years.

In August 1991 a tax treaty was finalized which exempted residents of Germany from the nonresident alien tax withholding. 4 Income From Real Property. The Convention further provides both.

Residents are regarded for US. US-German Social Security Agreement. This percentage increases up to 2020 by 2 per year and from then on by 1.

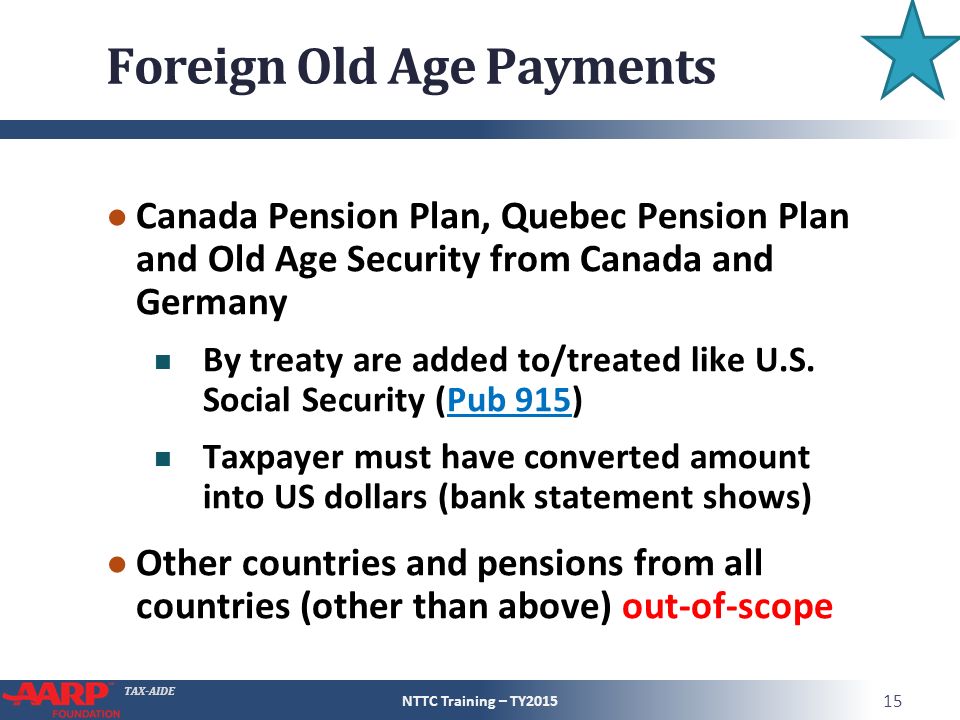

The treaty has been updated and revised with the most recent version being 2006. The United States has tax treaties with Germany and Canada whereby Social Security benefits paid by those countries to US. The exemption was effective.

The tax threshold is currently EUR 9408 for a single individual and EUR 18816 for those married.

Social Security Administration Wikipedia

The Complete J1 Student Guide To Tax In The Us

Income Tax In Germany For Expat Employees Expatica

Germany Taxing Wages 2021 Oecd Ilibrary

How To Germany American Expats And The Irs In Germany

The Complete J1 Student Guide To Tax In The Us

Understanding Tax Treaties And Totalization Agreements

Irs Pub 901 Usa Tax Treaties Edupass

The Us Uk Tax Treaty Explained H R Block

Can A Foreign Spouse Receive Social Security Benefits

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats

Income Tax In Germany For Foreigners Academics Com

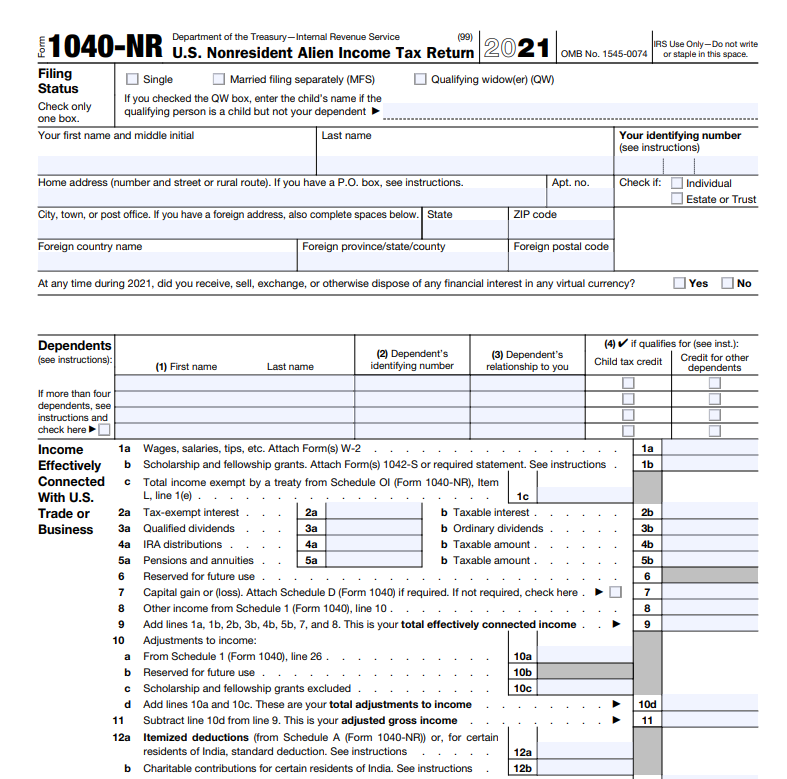

Social Security And Railroad Retirement Equivalent Ppt Video Online Download

Us Expat Taxes In Germany A Complete Guide

Germany United States International Income Tax Treaty Explained

Social Security Implications For Global Assignments Mercer

What Is The U S Germany Income Tax Treaty Becker International Law

Social Security Number Germany First Overview How To Apply For It Sib